Geo-information science must be financially feasible to be effective and generate impact. That is where Spatial Finance comes in. Adriano Barasal Morales, postdoctoral researcher of the Centre for Disaster Resilience of the ITC Faculty, is part of the team developing the new Spatial Finance materials for ITC’s education. Spatial Finance is currently a Choice Topic inside the "Food and Water Security in Iran" case in the MSc in Spatial Engineering. Spatial Finance will also be part of the Master’s in Geo-Information Science and Earth Observation curriculum. In this NRStory, Adriano shares with us the importance of spatial finance in the present and future of GIS and its process of integration into ITC’s education.

Integrating Finance and Geo-Information Science

In today's context, we are witnessing unprecedented growth in the accumulation of geospatial data. Satellites with the latest technology are orbiting the Earth, capturing high-resolution images of every corner of the globe. When associated with artificial intelligence to automatically scan and interpret this vast amount of visual data, the result is an ongoing process that enables real-time observation of large-scale changes occurring on a planetary level. The geospatial data rise combined with financial dynamics is what births the concept of 'Spatial Finance.' Spatial Finance refers to the integration of spatial data into financial decision-making processes. It is a relatively new term, first conceptualized by Oxford University’s Sustainable Finance Group.

Adriano Barasal is an economist specialized in spatial finance, and part of Natural Resources Department of the ITC Faculty (University of Twente)

“As with other disciplines, finance is heavily reliant on information access. In our global economy, timely and accurate data is key to understanding market trends, assessing risks, and identifying investment opportunities. However, the modern financial landscape is being increasingly influenced by climate change and supply chain complexity” Adriano discloses. The rise of droughts, wildfires, and floods continuously disrupt production and damage infrastructure. At the same time, many companies do not have a comprehensive grasp of their assets and raw material origins. In that context, spatial finance enhances transparency within the financial system.

Spatial Finance will soon be available for ITC students

The MSc in Spatial Engineering will include a Choice Topic about Spatial Finance in the "Food and Water Security in Iran" case, while the MSc in Geo-Information Science and Earth Observation includes Spatial Finance materials in a course under development. “The ITC Faculty is at the forefront of innovation to incorporate Spatial Finance in its curriculum. To my knowledge, this is the first course in Spatial Finance to be offered by a research institute at the master's level” affirms Adriano.

In these courses students will widen their applications in geospatial science, integrating elements of finance analysis. The concept of cost-benefit analysis (CBA) is the core of the content. This tool guides financial decisions and should provide substantial assistance to scientists and engineers in solving climate and social-related issues. “One thing we want our future professionals to bear in mind is that many global problems already have solutions, they are just not financially viable. They should create projects that can be financially implemented. I explain to our students that we have already found solutions for many problems, such as complex and very rare types of diseases, but they are not financially feasible to apply to every population. We need to design solutions to make it financially feasible. And with these new courses, our students will know how to create projects that are financially feasible” explains Adriano.

|

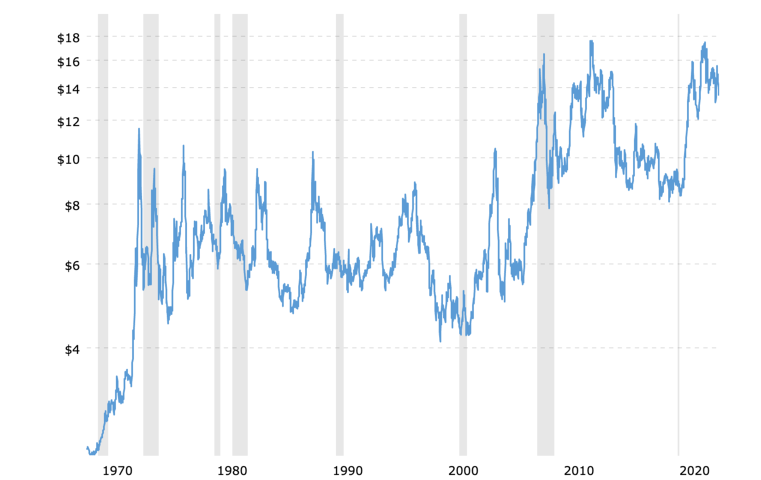

|

Normalized Difference Vegetation Index (NDVI) over the years in Africa continent. The NDVI exhibits a strong connection with the calculation of risk premiums employed by insurance companies each year. This association stems from the NDVI's ability to reflect the health and vitality of plant life, which, in turn, influences the likelihood of crop yield fluctuations and the corresponding financial risk for insurers. | Soybean historical price in dollars: Prices relate to scarcity. Utilizing geospatial data like regional climate indices can enhance the understanding of soybean price fluctuations by illustrating how distinct climatic conditions, such as droughts or abundant rainfall, influence the yields of soybeans. |

Despite being a relatively new field in the realm of Geo-Information Science, the ITC Faculty has quite some experience in Spatial Finance. The ITC Faculty is developing projects related to finance with global impact, like GIACIS. “Due to its experience, the ITC is in a privileged position to discuss Spatial Finance. The integration of this topic in our education materials was a natural next step for our Faculty” Adriano explains.

A multidisciplinary approach to creating value

Spatial Finance is not only made for finance practitioners. “I normally tell my students that the finance sector will always welcome anyone who creates value. In my past experience working in the finance sector, I remember that most of my superiors were not economists or managers, but rather with a very diverse background” confesses Adriano.

According to him, “This domain is not only relevant for those considering a job in the finance industry. Other research institutions, international organizations, and governmental agencies also benefit from spatial finance analysis to improve the life standards of local communities”. For instance, spatial finance provides answers about food scarcity and the rise of prices just by remotely assessing agricultural lands in a specific region. This information is not only relevant for investors but should also drive public policy to fight hunger and social unrest in impoverished areas.

|

|

Adriano working from his office at the Natural Resources Department of the ITC Faculty

However, the finance industry is also a good opportunity for GIS students. For example, GIS specialists with a background in finance can work in private companies, mutual funds, or even the market. “When I worked in the industry I was used to seeing very diverse backgrounds. People who studied physics, engineering, or other studies not related to finances, added a lot of value, so they were very welcome in the industry. This is also the case for Geo Information Scientists” says Adriano.

In this geospatial revolution, those who can generate information on image processing will be valuable assets in finance investigations – working in the financial sector or not. As he explains, “The information created by geoinformation scientists is already being incorporated in financial models, they just don’t know it yet”.

Contact Adriano for more information about ITC's education on Spatial Finance:

More recent news

Wed 3 Sep 2025PhD Defence Catalina Jaime Sanchez

Wed 3 Sep 2025PhD Defence Catalina Jaime Sanchez Mon 12 May 2025Pint of Science brings science to the pub – now also in Enschede

Mon 12 May 2025Pint of Science brings science to the pub – now also in Enschede Wed 13 Nov 2024Heather Handley wins international award for geoscience communication

Wed 13 Nov 2024Heather Handley wins international award for geoscience communication Fri 13 Sep 2024Reducing the impact of flooding in Kazakhstan

Fri 13 Sep 2024Reducing the impact of flooding in Kazakhstan Wed 26 Jun 2024New MSc programme Humanitarian Engineering will start in September 2025

Wed 26 Jun 2024New MSc programme Humanitarian Engineering will start in September 2025